Nonfungible tokens (NFTs), have been the talk of the town for several years. While large swathes of the public have struggled to understand why NFTs exist over the years, the demand has increased, institutions have been created, and the lingo has become part of our collective consciousness.

However, there is an elephant in this room: NFTs can be difficult to use and most of them are digital snake oils. These problems offer the possibility to find solutions. Both the legitimacy and accessibility of NFTs is ripe for reform. The market is maturing as more funding is available. This is driving momentum. NFT 2.0 is the new era. The technology will be easier to access by the general public, while the NFTs’ underlying value proposition will be clearer and more reliable.

Reflecting on NFT’s rise

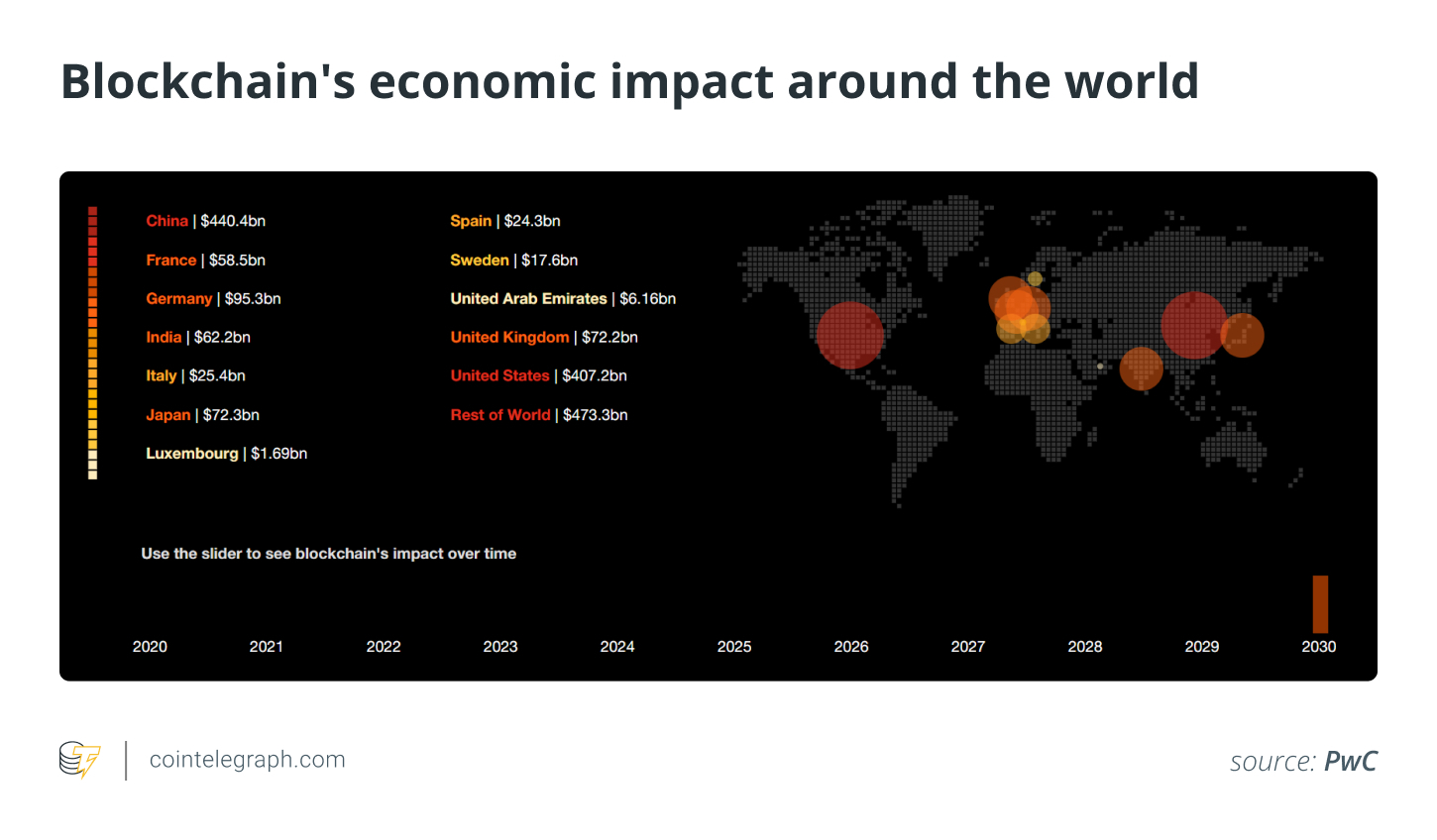

NFTs were only a short-lived phenomenon, with trading volume exceeding $17 billion in 2021. This number is predicted to rise to $147 billion in 2026. This is even more remarkable because this volume is owned only by fewer than 400,000. That’s $47,000 per user.

NFTs have seen a lot of changes in the past few years, along with their meteoric rise. CryptoPunks, which was free to mint in 2017, reached blue-chip status , with a $11.8-million sale at Sotheby’s last year. Larva Labs was the company that created the Punks. Yuga Labs, Bored Ape Yacht Club, purchased it for an undisclosed sum.

Evolution of NFTs

NFTs were dismissed early as a fad, but they have proven to be a huge success, drawing the attention of celebrities and major brands. They even appeared in Super Bowl commercials. Budweiser and McDonald’s have launched their own collections. Nike, however, has acquired RTFKT Studios.

Related: Why do major brands experiment with NFTs in metaverse?

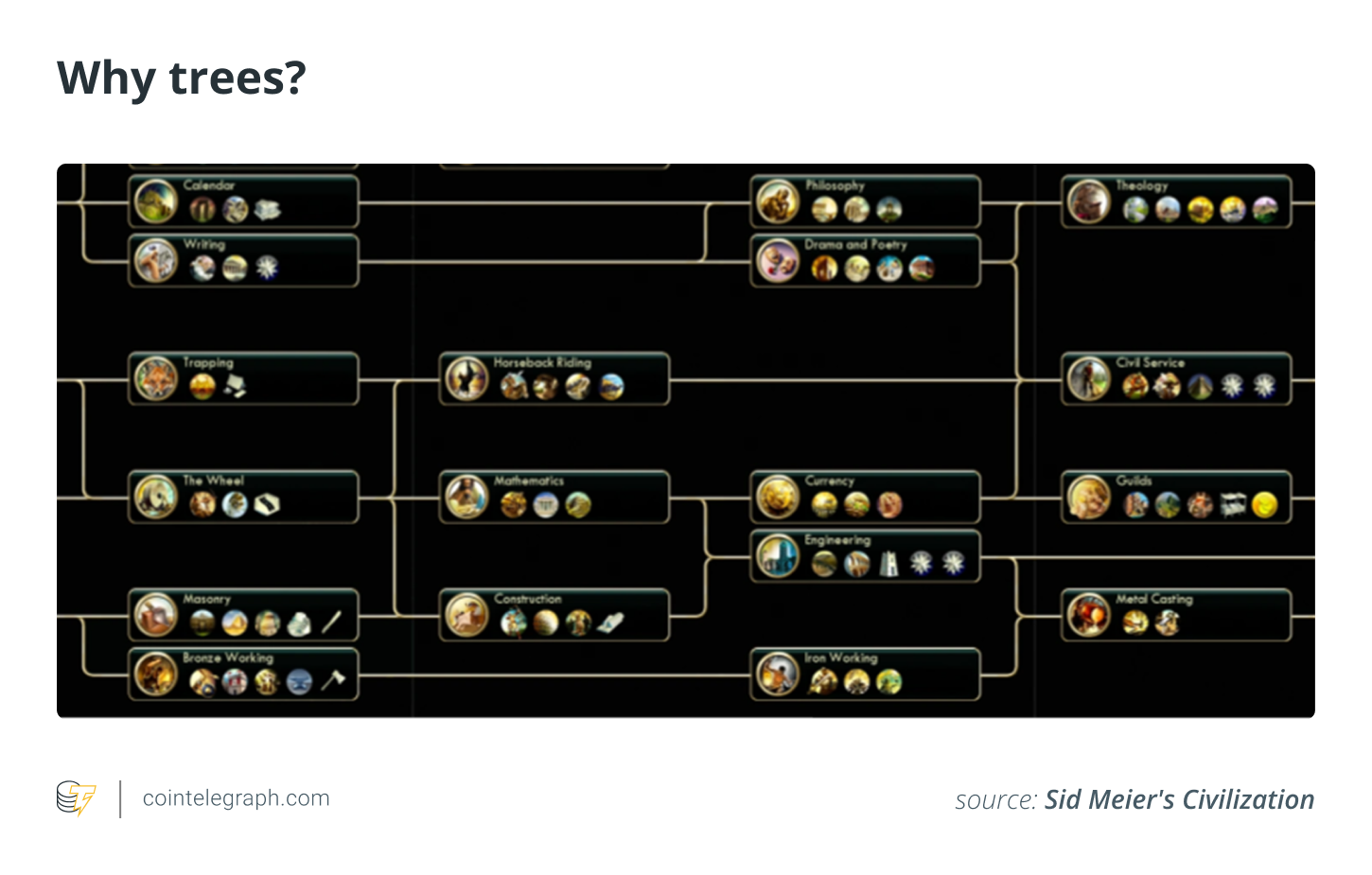

The NFT space is where organizations decide their strategy. However, it has been able to reflect the past decades of technological innovation with a much faster timeline. Although the iPhone was released in 2010, NFTs moved quickly from 8-bit pixelated images to complex play-to earn game mechanics to high-fidelity animations to large multiplayer experiences with huge multiplayer.

The actual NFTs are still in development, but the pick-and-shovel solution ecosystem is rapidly expanding. There has been a huge increase in NFT minting platforms, and tools that have helped to reduce the barriers to entry. This has led to deep saturation of the market. There were more NFTs in March 2022 than public websites. This has created a lot of noise that many have struggled to understand.

1/ OpenSea now has more NFTs than websites in 2010.

NFTs may soon outnumber websites and possibly webpages. This has important implications for how NFTs should be indexed.

— Alex Atallah (@xanderatallah)

March 9, 2022

The asset class’s longevity and its huge transaction volumes have changed the way creators approach this space. Many Web3 strategies have been rushed or used their fans as liquidity. This has led to many missteps, rug pulls, and abandoned projects. Simply put, Web3 is not the right platform for most creators and companies. They need more support and guidance than tools.

Just like email

NFTs may be headed in the same direction as email. In the 1990s, companies had to hire experts to code their emails. The first to adopt digital technology established lucrative agencies that could service Fortune 500 companies and implement early digital strategies. These agencies had tremendous information gaps that gave them enormous leverage. Then, technological advancement and education made it possible for brands to do this themselves.

Similar: We haven’t even started to tap into NFTs’ potential

We are in a similar era, where brands are seeking experts to prepare them for a Web3 future. It is only a matter time before they completely disintermediate and manage all aspects of their Web3 strategy in-house. Many people are unable to handle the complicated process of NFTs and crypto in general. However, some companies are finding ways to simplify crypto and create avenues for deeper engagement.

NFT 2.0 is built for the mainstream

NFTs are not intended for mainstream consumption. Consumers don’t find the onboarding process easy. The volatility can be damaging to true fans. It also skews the relationship between artist and fan. Too much is being done to discredit the NFT’s value and sticker price. Many collections are experiencing rough demand shocks due to their failure to follow their roadmaps.

NFT buyers are becoming more adept at rug pulling and other scams. This makes them less likely to create new collections. It’s easy for people to see the decline in volumes as doom. But the truth is that NFTs require a substantial washout to remove those who want to make quick money and incentivize true builders. The companies that are resilient and can weather the storms when they move from Web2 to Web3 without losing their vaporware will prosper. If platforms and agencies are not timed correctly, they will disappear. However, those who are prepared for an email-esque shift in their business will maximise high-margin, high touch projects and capture long-tail revenue streams.

This is important regardless of whether you are a builder, potential user, or investor. This area is expected to expand quickly and change rapidly. You might miss it if you blink.

Sterling Campbell and Mark Peter Davis co-authored this article.

This article is not intended to provide investment advice. Every trade and investment involves risk. Readers should do their research before making any decision.

These views, thoughts, and opinions are solely the author’s and do not necessarily reflect the views or opinions of Cointelegraph.

Mark Peter Davis, a serial entrepreneur and venture capitalist, is an author, community organizer, and author. Interplay is a leading venture capital firm in New York City. He is also the managing partner. He is also a podcaster and author of The Fundraising Rules. He is also the founder of the Columbia Venture Community as well as the Duke Venture Community.

Sterling Campbell serves as the CEO of Minotaur. Minotaur is a Web3 company that services top-tier creators. They also develop decentralized autonomous organizations and tokens. He spent most of his career working in consumer-focused tech at Blockchain Capital, Grishin Robics, William Morris Endeavor and Lerer Hippeau. Sterling received his bachelor of science degree in business and music industry from the University of Southern California, and his master of management from Columbia Business School.