Investment banking giant Citigroup has released research on how property technology could affect the housing market, mentioning virtual estate in the metaverse and cryptocurrency-backed mortgages.

Citi released Wednesday’s report, “Home of the Future — PropTech — Towards Frictionless Housing Market?” It stated that blockchain, crypto and property in the metaverse could transform the traditional real-estate market. However, many people have seen their investments in metaverse property increase in the past two years.

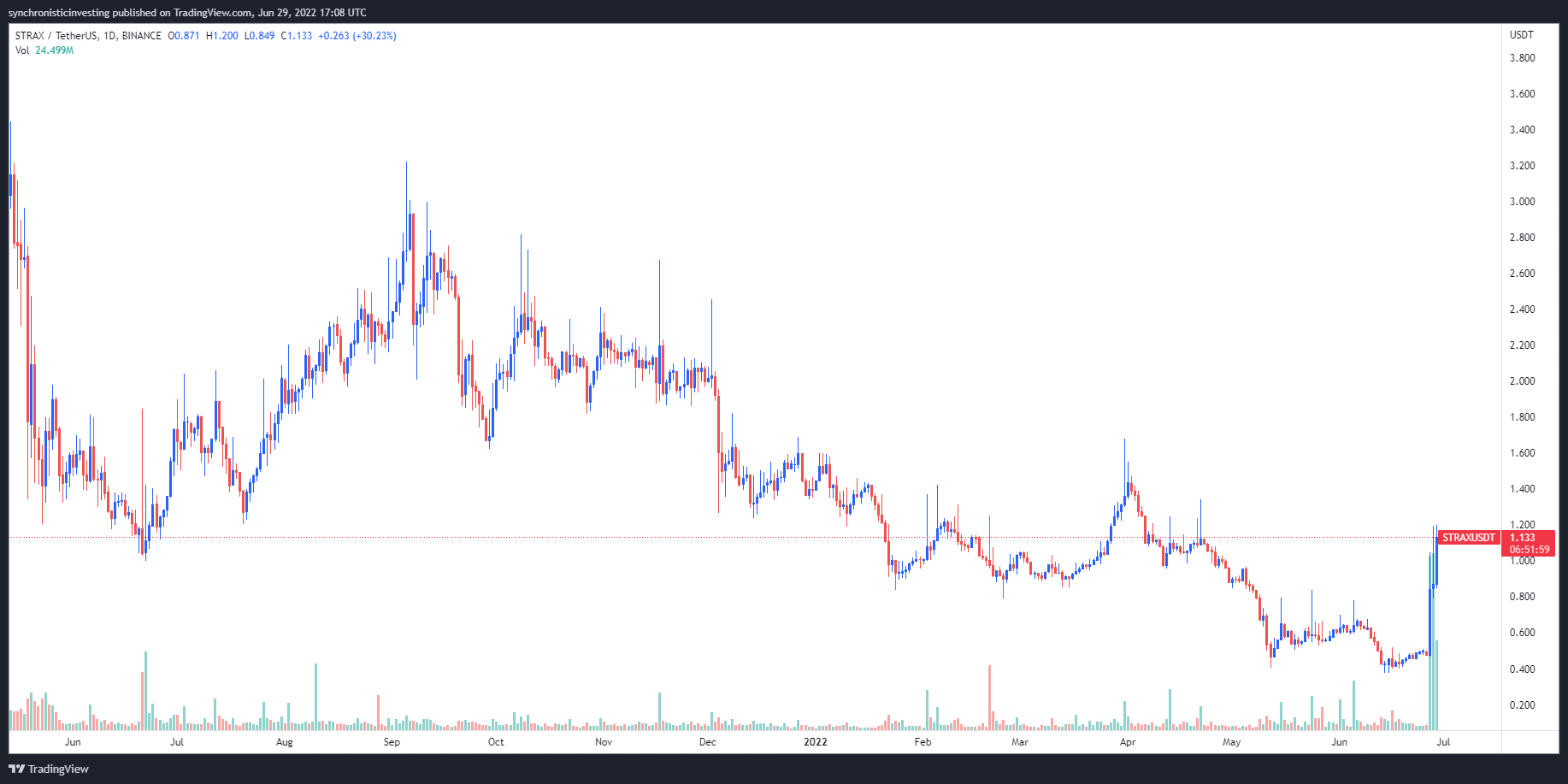

Citi stated that crypto assets may allow investors to “utilize your investment gains without incurring capital gains tax”, but also warned about the risk of a volatile market. Standard loans tied to fiat are subject to regulatory approvals to determine if a borrower is able to repay. Crypto holders may have to pay more if the price for tokens falls in a bear market.

The report stated that “if the cryptocurrency’s value drops, the borrower could be subject to margin calls, and eventually the cryptocurrency might be liquidated if it falls below a threshold such as 35% of the property valuation.” The overall risk of a loan is increased by introducing cryptocurrency exposure to the credit profile.

The Citi report highlighted the potential benefits of owning, monetizing and maintaining “digital real property” in the metaverse. Researchers analyzed how individuals and corporations have treated virtual property in The Sandbox ( LAND) as an investment similar to real property. Prices rose from $100 per LAND in January 2021, to $200,000 in a year.

“Given the nascent nature and virtual real estate environment, many purchasers of LANDs don’t have concrete plans to cultivate them and are simply speculating about the platform’s future growth and LAND price appreciation.

LAND is a virtual piece of real estate in The Sandbox #Metaverse. Owners have the freedom to create and customize fun experiences on their LAND as they wish. pic.twitter.com/wgdFCOkAS6

— The Sandbox (@TheSandboxGame).

May 11, 2022

Related: Propy and Abra partner to offer crypto-backed real property loans

This isn’t the first bank to look at the risks associated with crypto-backed mortgages. Before the current bear market, Florida-based ratings agency Weiss Ratings warned investors about the possibility that crypto mortgages could be a losing proposition due to falling Bitcoin prices ( BTC ), rising interest rates, and Federal Reserve policy changes.