On June 15, Nexo ( NEXO), fell as Nexo denied rumors that it was exposed to Three Arrows Capital (3AC), which is a Dubai-based crypto investment firm facing insolvency risk.

NEXO suffers from DeFi contagion Fears

NEXO is a security token that serves at a cryptocurrency loan platform. Its lowest price since January 2021 was $0.61 per unit.

This massive intraday drop was part of a wider downside move this week that pushed NEXO’s losses up to 40%.

NEXO’s performance was impacted by an continuing contagion within the crypto lending industry.

Traders fear that DeFi/CeFi companies, which offer high yields for clients on cryptocurrency deposits, may default on their debts after the market collapse of $1.5 trillion in 2022.

After the collapse in Terra, an algorithmic stablecoin project worth $40 billion, in May, there are still concerns.

Celsius Network, which offers clients up 18% yields , halted withdrawals one month later. Its clients had pulled nearly half of their assets from the platform since October 2021. This left it with approximately $12 billion to pay debt obligations.

Celsius should not be liquidated. This is customer money. Fuck the funds that are looking for this stop loss. I wish they get rekt. #bitcoin

Lark Davis (@TheCryptoLark).

June 14, 2022

3AC, a crypto hedge-fund, has seen liquidations of at most $400 million . On-chain data also shows that the firm could have a minimum debt position of $183 million and a collateral position at $235 million (derived from Staked Ether).

To repay the debt, the address uses USDT/USDC and withdraws Ethereum. Then, it converts ETH into USDT/USDC via “sinofate.eth”, and then repays it. The address sold 50kETH in less than 24 hours. https://t.co/TUzqXBXBwF

Wu Blockchain (@WuBlockchain).

June 15, 2022

If the fund becomes insolvent, it could pass on its economic risks to its creditors.

stated that the lenders will be responsible for the difference in the amount they owe versus the amount they receive when liquidating their collateral. Degentrading is a market commentator who has been known to highlight the Celsius Network’s liquidation issues.

He said:

“Defaults can cause significant equity erosion […]. Not all lenders are created equal. Celsius is the worst. It is now under. Nexo? I don’t think so. BlockFi is also pretty terrible.”

Nexo claims it does not currently have exposure to 3AC, despite having partnered with 3AC over a nonfungible token lending product in December 2021. According to the firm, the partnership with 3AC didn’t take off.

Three Arrows Capital has never signed a partnership agreement with Nexo. We currently have $0 in business and no exposure.

Nexo (@Nexo).

June 15, 2022

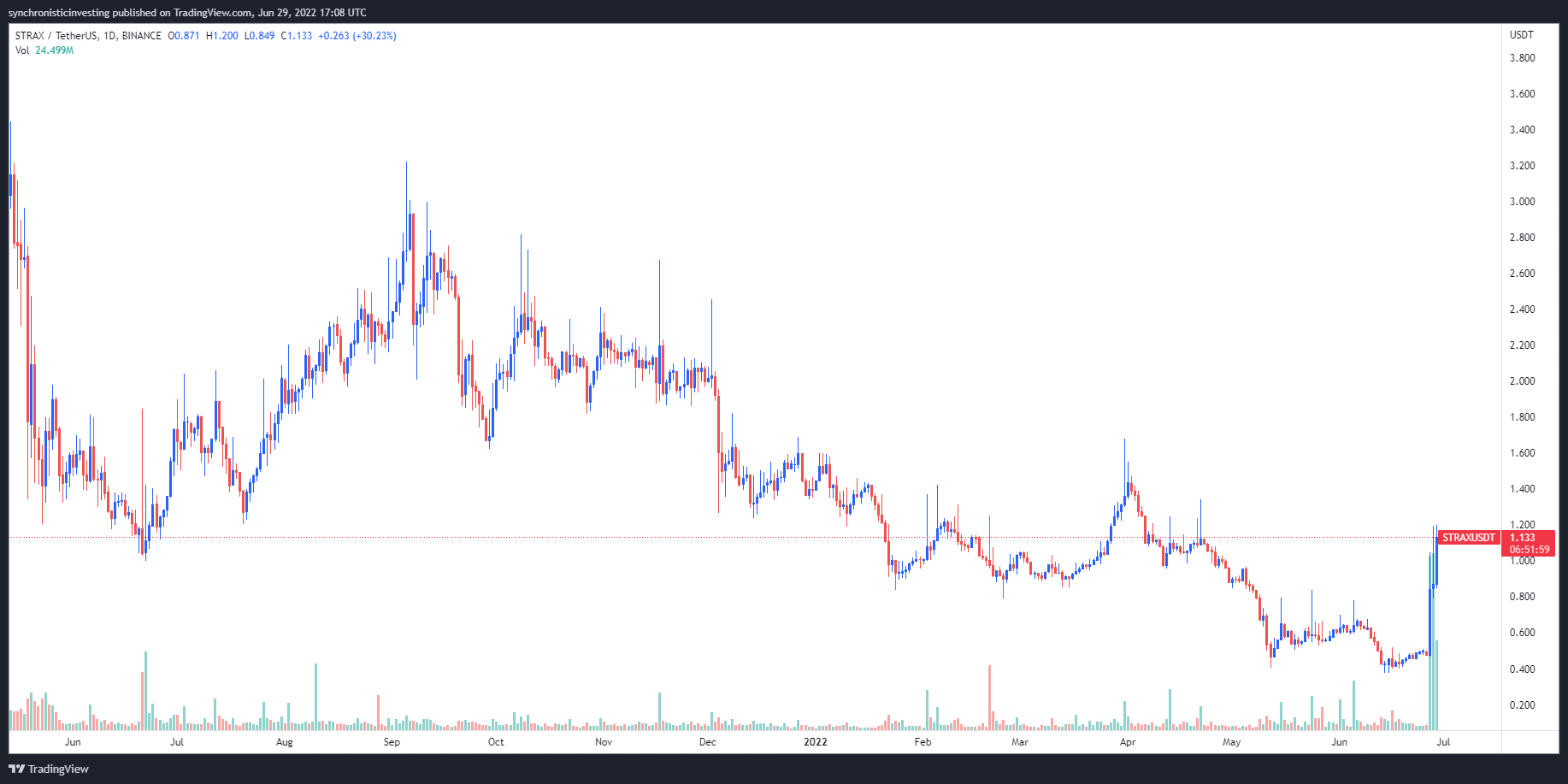

What’s next with the NEXO token

According to Armanino, a U.S.-based auditor firm, Nexo has 100% liquidity to pay its $4.96 million debt obligations. This increases the firm’s ability to avoid a liquidity crises in the event that the withdrawal rate rises, unlike Celsius.

Despite this, NEXO continues to move forward despite persistent bearish risk. This is primarily because of the dire state of crypto markets in a high-interest rate environment. Due to its historical importance from December 2020-2021, the NEXO/USD pairing now looks at the $0.58-$0.69 area as its interim support.

A rebound from the $0.58 to0.69 range could have NEXO bulls target $0.883. This level served as support in the price crash of early May. It now coincides with a 0.786 Fibonacci graph that shows the retracement graph from the $0.11-swing low up to the $3.71 high.

Related: Is there a bottom? Scaramucci, Raoul Pal and Scaramucci pile up, Novogratz, Hayes weight in

A decline below the $0.58 to $0.69 range could mean NEXO Watch December 2020’s support level close $0.43, which is down about 35% from today.

These views and opinions are the author’s and do not necessarily reflect those of Cointelegraph.com. You should do your research before making any investment or trading decision.