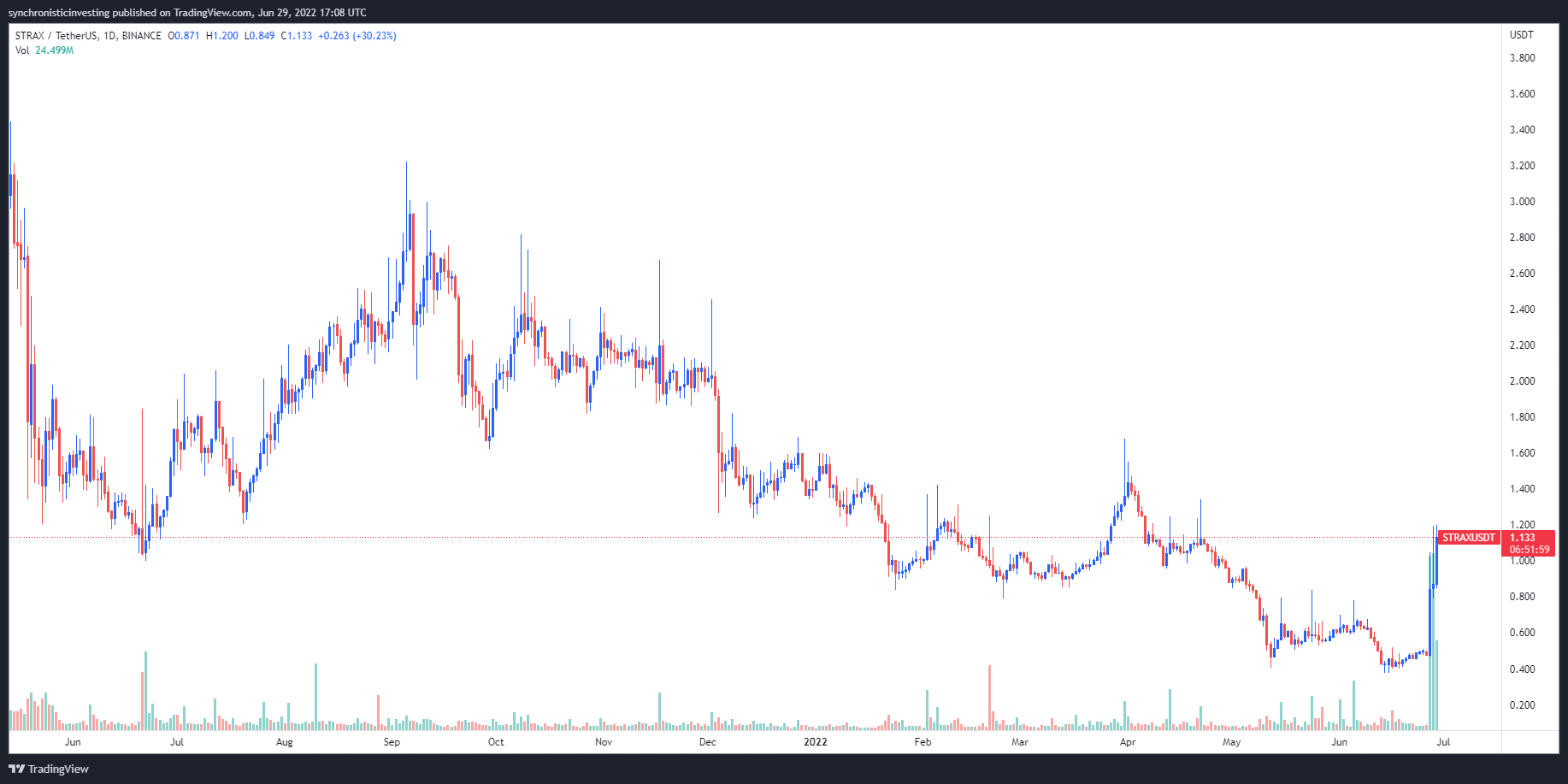

The last 30 days have seen a massive decline in STEPN (GMT), prices. This may be a sign that the trend is nearing its end.

GMT’s value has rebounded nearly 35%, from $0.80 on May 27, to $0.99 on May 28,. The upside retracement began after the price fell within the same range. This had served as support before GMT’s price rallies of 500% and 120% in March and May, respectively.

The rebound was further preceded by a 80% drop from its record high at $4.50 on April 27. This left GMT oversold per GMT’s daily relative strength index reading, which fell below the 30 threshold on May 26.

Technical support and oversold RSI suggest that GMT is nearing its bottom.

Watch the GMT price levels

The Fibonacci Retracement graph of GMT’s $0.0099-swing Low to $3.82-swing High leaves the token within a wider consolidation range. This is defined by the 0.382 Fib Line (near $1.50), acting as interim resistance, and the 0.786 Fib Line (near $0.82), serving as interim support.

A prolonged rebound from $0.82-support could bring $1.50 into focus as the next upside target. This is about 40% more than today’s price. A strong upside follow up could push the STEPN token towards $2-2.50, which would indicate that the market is at its bottom.

A weaker upside follow up could see GMT’s price test $0.82 to allow for a break down move towards $0.54. This level helped to cap the token’s downward attempts in March 17-21, earlier this year.

STEPN is a “hype-driven, speculative frenzy?”

The fundamental view of GMT’s bias is that it looks to be biased towards the negative.

First, the token trades in close-to-perfect tandem with Bitcoin ( BTC), and other top-cap cryptocurrency, according to their daily correlation coefficient readings. They topped 0.98 on May 21 but dropped to 0.75 on May 28, respectively.

If Bitcoin continues to struggle under $30,000, according to many analysts, it could take GMT Lower alongside because of its consistent positive correlation to the token.

Second, GMT may drop because of the growing uncertainties surrounding StePN’s business model. This involves users being paid to exercise by running, walking, or jogging with native Green Satoshi Tokens (GST).

It’s time to reach half a million followers! Once we reach 500k followers on Twitter, $1.5 million worth NFT will be given away (50 pairs BNBChain Genesis Sneakers).

1 Follow us

2 Retweet

3 Tag 3 friends & comment below pic.twitter.com/ngzXPxuXLwPublic Beta Phase IV (@Stepnofficial)

May 9, 2022

Mike Fay is an independent market analyst who also writes the Heretic Speculator Financial Newsletter. He says that STEPN’s so-called “move-to-earn” model is not sustainable or scalable in the long-term.

The analyst highlighted core issues in the “lifestyle application.”

First, STEPN is extremely difficult to enter. This makes it impossible for people to purchase its “Sneaker” NFTs. These digital issues are purchased for hundreds of dollars or even thousands of dollars by people who hope to earn and sell GST tokens.

Many users have already recovered their money. YouTuber Sebbyverse claimed that he earned $219 worth GST tokens by just walking 15 minutes for dinner.

Similar: People want crypto to exercise in Metaverse: Survey

Fay stated that “the way this likely ends” is with the last users who enter the platform essentially serving to be ‘exit liquidity for early adopters when GST-USD, the app’s payment token, collapses.

Users who have paid thousands of dollars to purchase Sneaker NFTs would see a decrease in their return on investment. Fay said that STEPN would struggle to attract new players to its app if there is less demand for NFTs and lower incentives. This would reduce demand for GMT. Fay added:

“STEPN is in a hype driven speculative frenzy. I’m not touching anything.” The payout token (GSTUSD), the governance token GMT or the NFTs are not included.

These views and opinions are the author’s and do not necessarily reflect those of Cointelegraph.com. You should do your research before making any investment or trading decision.