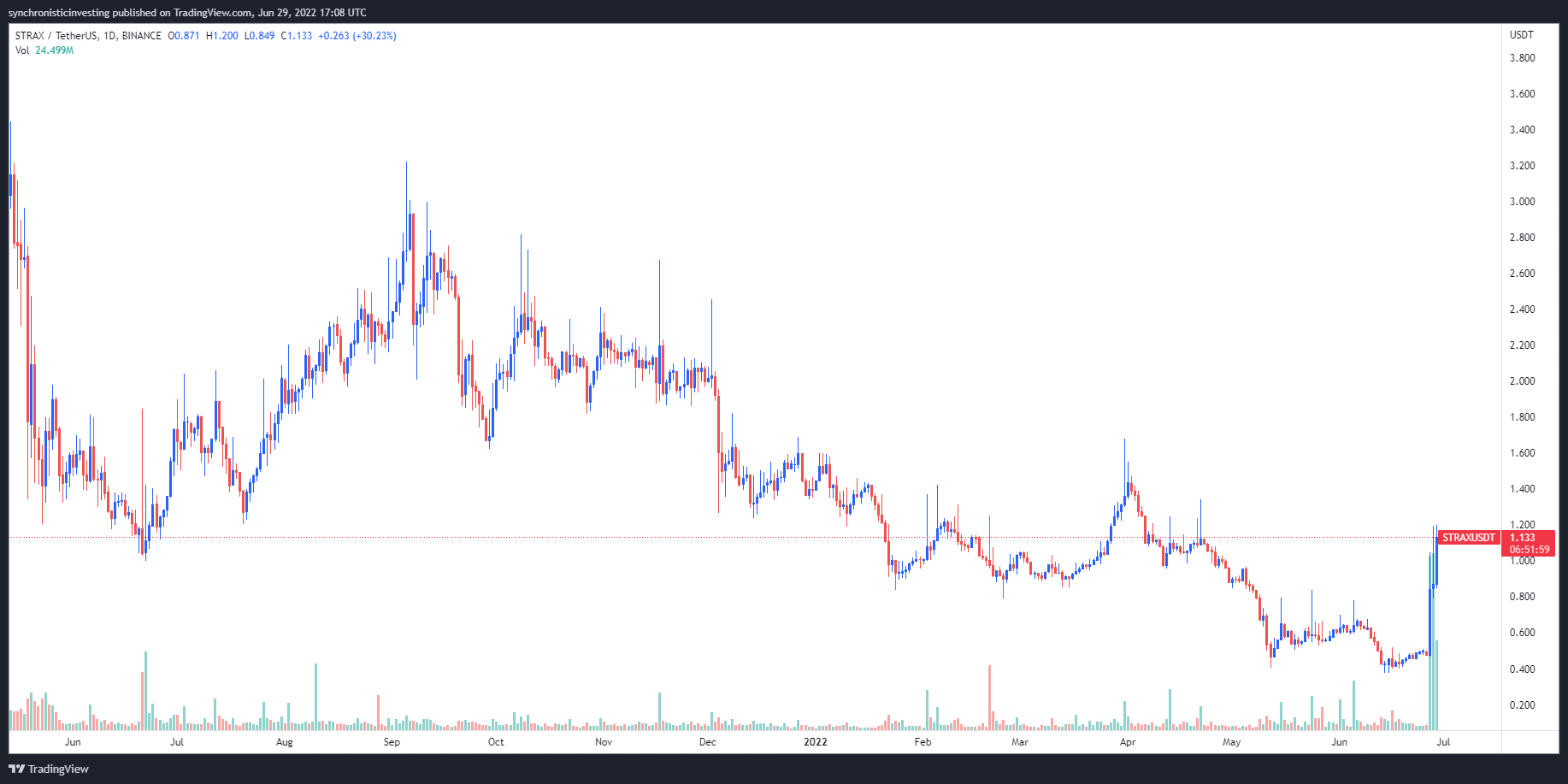

After testing $0.794 interim support, the price of Polygon ( MATIC), reversed its course and climbed by as much as 25% to $0.99 on May 10.

This rebound took place a day after the token fell over 17% to $0.787, its lowest point since July 2021. It was due to a global crash caused by the U.S. Federal Reserve’s hawkish policies.

MATIC price recovered after five days of continuous declines. It attracted buyers around the same support level as that was before the 275% bull run last summer.

An earlier retest of $0.787 in July 2021, and the 0.786 Fibline (near $0.61 of the Fibonacci trace graph — taken from the $0.002-swing high to 2.86-swing low — was followed by MATIC rising up to its record high at $3 by December 2021.

MATIC/USD could experience a sharp, similar upside retracement within the next weeks, after rebounding from the same support convergence.

MATIC basics: Now and Then

But, MATIC traders may be affected by the fact that market fundamentals have changed significantly between July 2021 to May 2022.

MATIC’s price boom was due to the skyrocketing transaction costs and gas prices, for instance.

Popular decentralized finance applications (DeFI) such as SushiSwap SUSHI, liquidity service Curve , and lending platform Aave AAVE, expanded their operations within the Polygon chain.

However, 2022 was a terrible year for cryptos. Investors have been reducing their exposure to riskier assets since the Fed decision to raise interest rates and unwind their $9 trillion balance sheet. MATIC’s year-to date paper returns were almost 65% lower than zero in May 10, due to the possibility of excess cash leaving the markets.

MATIC’s paper returns for the year were almost 65% lower than zero in May 10 due to the possibility of cash running out of the market.

Similar: 10 month BTC price drops spark $1B liquidation as Bitcoin eye $35K CME futures gap

“This is risk-off across all assets classes including crypto,” Daniel Ives (strategy at Wedbush Securities), stated to the Financial Times. He also said that digital asset investors “have no place to hide.”

“Some crypto investors play crypto like a hedge against inflation, but it’s trading as the Nasdaq’s Siamese twin.”

Meta: Silver lining in chaos

Ryan Watt , CEO of Polygon, announced on May 9 that Meta is partnering with them to create a platform for Instagram and Facebook using a nonfungible token.

Meta CEO Mark Zuckerberg also confirmed they had been “testing digital collectors for creators to showcase NFTs onto Instagram,” and that similar features would soon be added to Facebook. MATIC could benefit from the hype and establish a strong price floor.

Massive.

— Michael van de Poppe (@CryptoMichNL)

May 9, 2022

Technically, MATIC is at risk of a bearish continuation towards $0.615 in May.

Until the token reclaims the 50-week exponential moving mean (50-week EMA, the red wave), a bullish confirmation is less likely.

These views and opinions are the author’s and do not necessarily reflect those of Cointelegraph.com. You should do your research before making any investment or trading decision.